Scopri i marchi delle nostre divisioni: Henkel Adhesive Technologies e Henkel Consumer Brands.

7 mar 2023 Düsseldorf / Germany

Henkel delivers significant sales increase in 2022 – poised for further growth in fiscal 2023

- Full year results 2022:

- Group sales: 22.4 billion euros, organic growth* of 8.8 percent

- Operating profit (EBIT)**: 2.3 billion euros, -13.7 percent

- EBIT margin**: 10.4 percent, -3.0pp

- Earnings per preferred share (EPS)**: 3.90 euros, -17.8 percent at constant exchange rates

- Proposed dividend on prior-year level: 1.85 euros per preferred share

- Good progress in implementing Purposeful Growth Agenda

- New business unit Consumer Brands live

- Sustainability driven forward in key areas

- Outlook for fiscal 2023: further growth expected

- Organic sales growth: 1.0 to 3.0 percent

- EBIT margin**: 10.0 to 12.0 percent

- Earnings per preferred share (EPS)**: between -10.0 and +10.0 percent (at constant exchange rates)

“In 2022, we achieved significant sales growth and a robust earnings performance in a very challenging year – and we implemented important strategic measures. We succeeded in partially compensating the dramatic rise in raw material and logistics costs through higher prices and continued efficiency improvements. This is reflected in our sales, which reached a new high of around 22.4 billion euros, and an operating profit of 2.3 billion euros. Based on that, we are proposing to our shareholders a stable dividend at prior-year level. By merging our consumer businesses into the Consumer Brands business unit, we have also successfully launched one of the biggest transformations of our company in recent decades,” said Henkel CEO Carsten Knobel.

“Thanks to the great commitment of our global team, our strong culture and with a clear, long-term growth strategy, we have overall mastered the challenges of the past fiscal year well. I see us well equipped to navigate Henkel through these difficult times and to achieve our ambitious goals. We are poised for further growth in the current fiscal year – driven by our two business units Adhesive Technologies and Consumer Brands.”

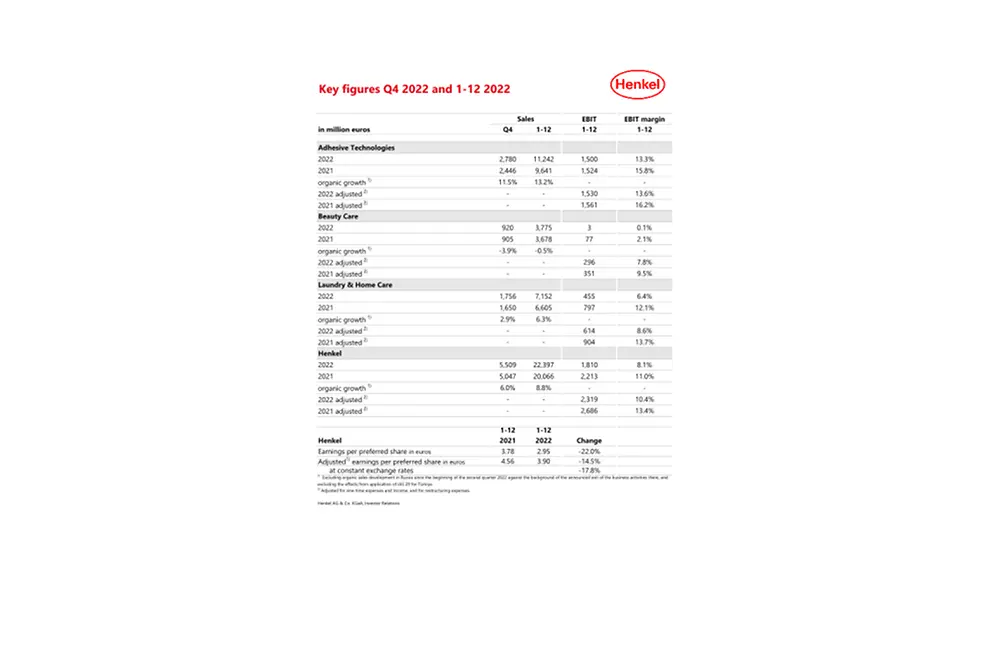

Group sales and earnings performance in fiscal 2022

Henkel Group sales reached 22,397 million euros in fiscal 2022. This corresponds to a nominal growth of 11.6 percent and to a significant organic sales growth of 8.8 percent, driven by price increases across all business units. The impact of acquisitions and divestments on sales was slightly negative at -1.1 percent. Currency effects had a positive impact of 3.9 percent on sales.

The Adhesive Technologies business unit achieved double-digit organic sales growth of 13.2 percent, to which all business areas contributed. Organic sales development in the Beauty Care business unit was slightly negative at -0.5 percent. While the ongoing recovery in the Hair Professional business had a positive effect, Beauty Care’s consumer business was impacted in particular by the implementation of the announced portfolio measures. The Laundry & Home Care business unit generated very strong organic sales growth of 6.3 percent, driven particularly by significant growth in the Laundry Care business area.

The emerging markets achieved double-digit organic sales growth of 13.3 percent. The businesses in the mature markets recorded a strong organic sales performance of 5.2 percent.

Adjusted operating profit (adjusted EBIT) reached 2,319 million euros compared to 2,686 million euros in fiscal 2021 (-13.7 percent). The impact of significantly higher prices for raw materials and logistics weighed on the Group's profitability and could not be fully offset by positive price developments and continued measures to reduce costs and increase efficiency in production and supply chain.

At 10.4 percent, adjusted return on sales (adjusted EBIT margin) in the reporting year was below the level of the previous year (2021: 13.4 percent).

Adjusted earnings per preferred share decreased by -14.5 percent to 3.90 euros (previous year: 4.56 euros). At constant exchange rates, this corresponds to a development of -17.8 percent.

Net working capital as a percentage of sales increased to 4.5 percent, up 2.3 percentage points compared to the previous year. This increase in net working capital was attributable above all to significantly higher prices for direct materials.

Free cash flow reached 653 million euros, a significant decrease versus the previous year (2021: 1,478 million euros). This was due to the higher net working capital and to lower cash flow from operating activities as a result of lower operating profit.

The net financial position was -1,267 million euros (December 31, 2021: -292 million euros). This also reflects expenditures relating to the share buyback program launched in February 2022, and the dividend payment in the second quarter.

The Management Board, Supervisory Board and Shareholders’ Committee will propose to the Annual General Meeting on April 24, 2023, a stable dividend relative to the previous year of 1.85 euros per preferred share and 1.83 euros per ordinary share. This equates to a payout ratio of 46.6 percent, which is above the target range of 30 to 40 percent and reflects the unusual burden on earnings caused in particular by considerably higher commodity prices and logistics costs. This payout is possible thanks to the strong financial base and low net debt of the Henkel Group. Thus, Henkel can maintain dividend continuity for its shareholders.

Business unit performance in fiscal 2022

In fiscal 2022, sales of the Adhesive Technologies business unit increased nominally by 16.6 percent to 11,242 million euros. Organically, sales grew by 13.2 percent. This sales growth was driven by a double-digit development in price. Adjusted operating profit was slightly lower year on year at 1,530 million euros (2021: 1,561 million euros). Adjusted return on sales reached 13.6 percent, compared to 16.2 percent in the prior year. This was due mainly to a declining gross margin adversely affected by the substantial price increase for direct materials.

In the Beauty Care business unit, sales declined nominally by -2.6 percent in fiscal 2022 to 3,775 million euros. Organically, sales decreased slightly by -0.5 percent. This was due to different developments. While the Hair Professional business achieved very strong sales growth, the consumer business was organically below the prior-year level, in particular due to the implementation of the announced portfolio measures. Adjusted operating profit reached 269 million euros (previous year: 351 million euros). Adjusted return on sales decreased to 7.8 percent (previous year: 9.5 percent). In addition to the decline in gross margin, this was partly due to a slight increase in investments in marketing and advertising.

Sales of the Laundry & Home Care business unit increased by 8.3 percent in nominal terms in fiscal 2022, reaching 7,152 million euros. Organically, sales rose by 6.3 percent. The increase in sales was price-driven, while volumes declined. At 614 million euros, adjusted operating profit was below the level of the previous year (904 million euros). Adjusted return on sales decreased to 8.6 percent, mainly due to the decline in gross margin as a result of significantly higher raw material and logistics prices and an increase in marketing and advertising expenses.

Outlook 2023

Global economic growth is expected to continue to weaken in 2023. According to current estimates, the global economic environment is expected to remain inflationary in fiscal 2023, due to anticipated labor cost increases and continued high energy and commodity costs. In this context, average prices for direct materials are expected to increase by a low to mid-single-digit percentage compared to the 2022 annual average. In addition, interest rates are likely to remain significantly higher than in previous years. It is therefore assumed that industrial demand will be more subdued than in the previous year, and that the growth momentum of consumer demand in key areas of Henkel's consumer goods business will slow down. In addition, the business activities in Russia are expected to be divested by the end of the first quarter of 2023.

Taking these factors into account, Henkel expects to generate organic sales growth of between 1.0 and 3.0 percent in fiscal 2023, with both business units anticipated within this range. Adjusted return on sales (adjusted EBIT margin) is expected in the range of 10.0 to 12.0 percent. Adjusted return on sales is expected to be between 13.0 and 15.0 percent for Adhesive Technologies and between 7.5 and 9.5 percent for Consumer Brands. For adjusted earnings per preferred share (EPS) at constant exchange rates, Henkel expects a development in the range of -10.0 to +10.0 percent.

Purposeful Growth Agenda sucessfully implemented

Despite the difficult macroeconomic and geopolitical environment, Henkel continued to consistently implement its strategy in 2022. The company further developed its business and brand portfolio, strengthened its competitive edge in the areas of innovation, sustainability and digitalization, optimized its operating models and fostered its corporate culture. A key strategic focus in 2022 was the merger of the Laundry & Home Care and Beauty Care business units into the integrated Consumer Brands unit.

New business unit Consumer Brands successfully established

At the end of January 2022, Henkel announced one of the biggest transformations of the company in recent decades: the merger of its two consumer businesses into one integrated business unit, named Consumer Brands. The new business unit, which has been successfully established since the beginning of 2023, brings together all consumer brands across all categories under a single roof, including iconic brands such as Persil or Schwarzkopf and the Hair Professional business. By that, Henkel is creating a multi-category platform for future growth of around 11 billion euros sales in 2022.

With the merger, Henkel intends to increase profitability in the consumer goods business and thus throughout the Group, and to generate additional growth momentum. To this end, the portfolio around the global Laundry & Home Care and Hair categories will be focused on strategic businesses and brands with attractive growth and margin potential. During the integration, significant synergies are expected, some of which will be used for targeted investments in strategic priorities such as innovation, sustainability, and digitalization, as well as to strengthen the margin and growth profile of the business unit.

In the mid-term, Henkel aims to realize gross savings (before reinvestments) of around 500 million euros. Synergy potential arises from adapted sales and administrative structures, more focused advertising and marketing, and an optimized supply chain. Implementation will take place in two phases: In the first phase, measures being implemented by the end of 2023 will result in net savings of around 250 million euros on an annual basis – with full impact on earnings from 2024 onwards. First net savings of around 60 million euros were already achieved in 2022.

The company also made strong progress in transforming its consumer portfolio: Here, Henkel had announced to review up to 1 billion euros of sales. In 2022, around 400 million were already successfully executed – about 200 million euros of this relates to portfolio optimization measures, the remaining 200 million euros are attributable to divestments. The result is a fundamental portfolio transformation with the global exit from the Oral and Skin Care categories, and from selective Body Care markets. Going forward, Henkel will continue to review its portfolio and further reduce complexity.

The second phase of the implementation will focus on supply chain excellence. To this end, Henkel wants to improve efficiency in its own production set-up and optimize the contract manufacturers network and its procurement costs. Living up to the “one face to the customer”-principle, the company also wants to drive the commercial integration with optimized logistics capabilities. The second phase of the integration is currently started, and the measures are expected to be mostly implemented by the end of 2025. From these measures, Henkel expects additional annual net savings of around 150 million euros, to be fully realized from 2026 onwards. At the same time, the second phase is associated with one-time costs of around 250 million euros and capital expenditures. The corresponding parts for 2023 are included in the outlook for this fiscal year.

Consistent progress across all strategic pillars of Purposeful Growth Agenda

As part of its active portfolio management, in addition to discontinuing or divesting activities, Henkel has further developed its portfolio through acquisitions. The company acquired Shiseido’s hair salon business in the Asia-Pacific region and thus strengthened its position in this attractive market with its premium hair care, coloring and styling products. In the Adhesive Technologies business unit, Henkel expanded its expertise in innovative surface technologies and thermal management solutions with two technology acquisitions.

In 2022, Henkel again launched numerous innovations onto the market, addressing important trends and creating value for customers and consumers. In Adhesive Technologies, a new conductive coating solution for the fast-growing electric vehicle battery market was introduced. The technology enhances battery performance by increasing conductivity inside the battery cell up by up to 30 percent and also enables a reduction of more than 20 percent of overall energy consumption in the manufacturing process. In the Beauty Care business unit, for example, Henkel launched Colour Alchemy, a hair color innovation for unique color effects based on its leading expertise in hair technology. And in Laundry & Home Care, innovative cleaning gels for dishwashers were launched under the Somat brand.

In addition, Henkel further anchored sustainability in the business. Henkel introduced its "2030+ Sustainability Ambition Framework" with new ambitions and targets last year. In 2022, Henkel increased the proportion of electricity from renewable sources to 70 percent, bringing the company closer to its ambition of climate-positive operations by 2030. Henkel has also strengthened the sustainability of its product portfolio, for example by using more renewable and recycled raw materials. Through a partnership with BASF, Henkel aims to replace up to 110,000 metric tons of chemical raw materials for consumer products manufactured in Europe with renewable raw materials as part of a biomass balance process. In addition, Henkel has also issued another bond with a volume of 650 million euros, which is linked to the achievement of specific sustainability targets.

Henkel also advanced in digitalization and increased the share of digital sales in Group sales to more than 20 percent. In addition, structures were further optimized in the company’s digital unit, Henkel dx, and new business opportunities were created, with the RAQN digital business platform making an important contribution.

With regard to future-ready operating models, the focus in 2022 was on merging the Laundry & Home Care and Beauty Care business units.

In addition, the company culture was further strengthened – based on the corporate purpose "Pioneers at heart for the good of generations" and Henkel’s established "Leadership Commitments". In this respect, Henkel continued to implement new training and development programs, as well as the holistic Smart Work concept, which provides a global framework for mobile working, the design of the working environment and health initiatives for employees.

“We are deeply convinced that with Consumer Brands we have laid the foundation for further profitable growth of our consumer business and our entire company. In Adhesive Technologies, we are systematically focusing on the megatrends of sustainability, mobility and connectivity, and we want to leverage the global leading market position of this business unit to further increase its growth and profitability in the coming years. We are thus well positioned. We have the right strategy and a strong team. I am full of confidence that we will achieve our ambitious goals and successfully execute our purposeful growth agenda,” Carsten Knobel summarized.

* Excluding organic sales development in Russia since the beginning of the second quarter 2022 against the background of the announced exit of the business activities there and excluding the effects from application of IAS 29 for Türkiye.

** Adjusted for one-time expenses and income, and for restructuring expenses.

This document contains statements referring to future business development, financial performance and other events or developments of future relevance for Henkel that may constitute forward-looking statements. Statements with respect to the future are characterized by the use of words such as expect, intend, plan, anticipate, believe, estimate, and similar terms. Such statements are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. These statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially (both positively and negatively) from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update forward-looking statements.

This document includes supplemental financial indicators that are not clearly defined in the applicable financial reporting framework and that are or may be alternative performance measures. These supplemental financial indicators should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial position or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.